XRP Price Prediction: Analyzing the Path to $5 and Beyond

#XRP

- Technical indicators show bullish momentum with MACD above signal line and price above key support levels

- Growing institutional demand evidenced by $1B CME futures open interest and partnership developments

- Regulatory clarity on ETF decisions in October 2025 could serve as significant catalyst for price movement

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Support

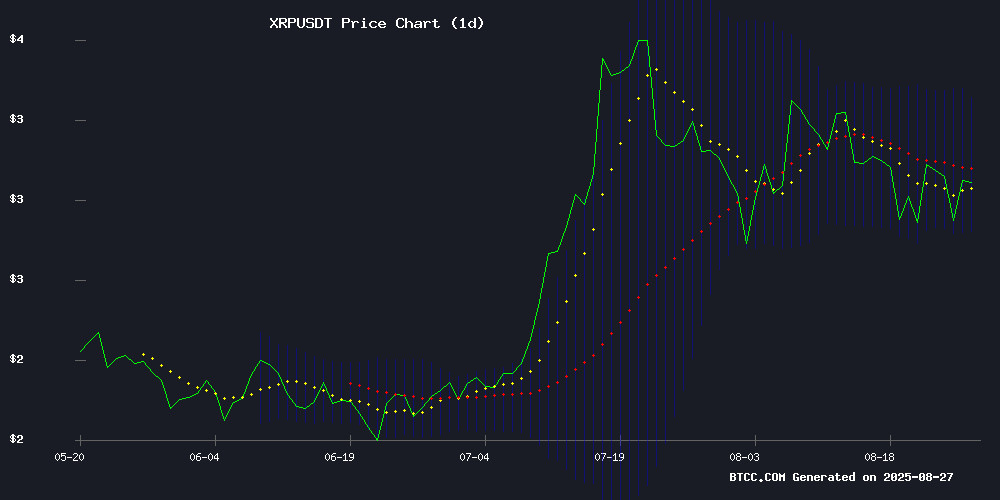

XRP is currently trading at $3.0053, slightly below its 20-day moving average of $3.0735, indicating potential consolidation. The MACD reading of 0.1434 above the signal line at 0.0811 suggests building bullish momentum. According to BTCC financial analyst Mia, 'The price holding above the Bollinger Lower Band at $2.8164 provides strong support, while the upper band at $3.3307 presents the immediate resistance target.'

Market Sentiment: Regulatory Developments Drive XRP Optimism

Positive news FLOW surrounding XRP is creating constructive market sentiment. The partnership between Gemini and Mastercard for XRP rewards credit cards, coupled with institutional demand shown by $1B open interest on CME futures, indicates growing adoption. BTCC financial analyst Mia notes, 'While SEC delays on the WisdomTree ETF until October create short-term uncertainty, the underlying institutional interest and cross-border finance partnerships with Linklogis provide fundamental support for price appreciation.'

Factors Influencing XRP's Price

XRP Eyes $3.20 as Bull-Flag Pattern Forms Amid Regulatory Uncertainty

XRP futures surged past $1 billion in open interest within three months of launch on CME Group, marking the fastest adoption rate for any new contract in the platform's crypto suite. The milestone comes as institutional interest grows despite ongoing U.S. regulatory concerns surrounding Ripple's cross-border payment technology.

Federal Reserve Chair Jerome Powell's Jackson Hole comments injected optimism into crypto markets, with XRP gaining 3.6% to test the $3.08 resistance level before settling near $2.99. A 167.6 million volume spike during the rally suggests strong institutional participation, though the token faces persistent headwinds from its legal battle with the SEC.

Technical indicators show XRP building support at $2.89, with RSI momentum climbing from oversold territory into the mid-50s. The bull-flag pattern now points to a potential $3.20 target if buyers can sustain pressure above the psychological $3.00 threshold.

XRP Price Projections: Analyst Forecasts $27 Target Amid Market Optimism

EGRAG Crypto, a prominent XRP bull, has dismissed $4 as a cycle peak, projecting instead a staggering $27 target for the cryptocurrency. This outlook is grounded in Fibonacci extension analysis, suggesting potential milestones at $8, $13, and ultimately $27. XRP's current price of $2.9 and its impending first two-month close above $2 signal robust momentum.

Institutional interest and growing futures activity underscore XRP's resilience despite recent market volatility. While other analysts, like Crypto Rover, peg the cycle high at $3-$4, EGRAG's technical framework paints a far more ambitious trajectory. The $2 threshold, if sustained, could mark a historic inflection point for the asset.

Ripple CEO Endorses Gemini’s XRP Rewards Credit Card in Major Crypto Adoption Push

Ripple CEO Brad Garlinghouse has publicly championed Gemini's newly launched XRP rewards credit card, calling attention to the product's 4% back in XRP on purchases. The card—developed through a partnership between Gemini, Mastercard, and Ripple Labs—represents a strategic move toward integrating cryptocurrency into mainstream financial activity.

Gemini's app surged past Coinbase in U.S. downloads following the card's debut, signaling strong market interest. The offering includes no annual fee and a $200 sign-up bonus, further sweetening the deal for crypto enthusiasts.

Garlinghouse's social media endorsement underscores Ripple's commitment to expanding XRP's utility. "What a time to be alive, XRP family..." he posted, alongside an image of the card. The community has welcomed the product as a tangible step toward broader digital asset adoption.

SEC Delays WisdomTree XRP ETF Decision to October 2025

The U.S. Securities and Exchange Commission has pushed back its decision on WisdomTree's proposed XRP exchange-traded fund to October 24, 2025. The delay affects all pending XRP ETF applications except Franklin Templeton's filing, as regulators seek additional time for review.

XRP's price held steady at $2.96 despite the regulatory setback. Market observers note that amended filings from issuers suggest constructive dialogue with SEC staff, though the extended timeline reflects the agency's cautious approach to crypto investment products.

WisdomTree's proposal was among the first spot XRP ETF filings in the U.S. market. Grayscale and other issuers now face similar delays as the SEC maintains its methodical evaluation process for digital asset funds.

Investor Sees Opportunity in XRP Ahead of Key SEC ETF Decisions

Ripple's XRP has rebounded with a 6% gain today after recent market weakness tied to inflation concerns and regulatory uncertainty. The SEC's delay in deciding on two XRP-focused ETFs—now scheduled for mid-October—has injected volatility into the token's trajectory.

Keith Noonan, a prominent investor, suggests the pullback presents a buying opportunity. "Load up ahead of October," he advises, pointing to the Grayscale and 21Shares ETF rulings as potential catalysts. Market sentiment remains bifurcated, with macroeconomic headwinds offset by anticipation of institutional adoption pathways.

3 Reasons To Buy Ripple (XRP) Like There’s No Tomorrow

XRP trades near $3.00 with a $175B market cap as regulatory clouds lift and utility expands. The SEC's $125M settlement and dismissal of appeals in August 2025 cemented legal clarity, removing delisting risks that haunted exchanges since 2020.

XRPL's 3-5 second settlements and 0.00001 XRP fees now complement an EVM sidechain launched June 2025, merging Solidity compatibility with native AMM liquidity. Stablecoin demand grows alongside these infrastructure upgrades, positioning XRP as a bridge between traditional finance and blockchain efficiency.

Ripple CTO Promotes Gemini XRP Credit Card with Mastercard Partnership

Ripple's Chief Technology Officer David Schwartz unveiled the newly launched XRP rewards credit card in San Francisco, marking a significant step in integrating digital currencies with mainstream financial products. The XRP edition of the Gemini Credit Card, launched under the Mastercard World Elite program, offers up to 4% rewards in XRP on everyday purchases and up to 10% at select merchants.

Schwartz showcased the card at XRPresso café, dressed in XRP-branded attire, emphasizing Ripple's commitment to token adoption. "Got my XRP belt on, wearing an XRP t-shirt, holding an XRP rewards credit card at XRPresso," he remarked, highlighting the card's no-fee structure and global appeal.

The launch aligns with Ripple CEO Brad Garlinghouse's vision of enabling users to earn crypto through daily transactions. This move signals growing institutional confidence in XRP's utility as a payments-focused digital asset.

XRP Futures Hit $1B Open Interest on CME in Record Time, Signaling Institutional Demand

XRP has become the fastest asset to reach $1 billion in open interest on CME Group's crypto derivatives platform, achieving the milestone just three months after its futures launched in May 2025. The surge reflects growing institutional participation, with 251,000 contracts traded totaling $9.02 billion in notional volume.

CME's XRP futures—offered in standard (50,000 XRP) and micro (2,500 XRP) contracts—now average $143 million in daily trading activity. Liquidity improvements and tighter spreads suggest deepening market maturity, with analysts calling this the precursor to a "hated rally" as skeptics confront accelerating adoption.

XRP Tests Key Fibonacci Levels as Traders Eye $5 Threshold

XRP hovers near $2.95, a critical Fibonacci retracement level that could serve as a launchpad for further gains. Technical analysts highlight upside targets at $3.59, $4.63, and $5.67—milestones that would require decisive breaks through resistance zones.

Market sentiment remains cautiously optimistic despite broader crypto volatility. XRP's relative stability compared to Bitcoin and Ethereum suggests accumulating interest from both retail and institutional traders. The $2.55 level now acts as a defensive line for bulls should momentum fade.

Immediate resistance clusters around $3.35, with $3.59 representing the key psychological barrier. A confirmed breakout could accelerate moves toward higher Fibonacci extensions, though current price action remains constrained within the prevailing range.

Linklogis Partners with XRP Ledger to Enhance Cross-Border Finance

Linklogis, a leading Chinese supply chain fintech firm, has forged a strategic partnership with the XRP Ledger (XRPL) to revolutionize cross-border finance. Announced on August 25, this collaboration will integrate Linklogis' global digital supply chain finance platform with XRPL, enabling seamless settlement of trade-based digital assets across borders.

The move marks Linklogis' entry into decentralized finance while reinforcing its innovation in international trade finance. Future initiatives include co-development of stablecoin solutions, smart contract-enabled trade asset exchanges, and AI-blockchain integration for global trade applications.

Linklogis' global footprint continues to expand, serving clients in 27 countries with RMB 20.7 billion in cross-border assets processed in 2024. The company's recent ventures include participation in Project Dynamo for asset tokenization and founding SuperFi Labs, a DeFi innovation hub.

XRP Sparks a New Income Trend: US Investors Earn 1,100 XRP Daily via Cloud Mining Platform

XRP's 480% surge this year has shifted investor focus from mere accumulation to income generation. Topnotch Crypto, a cloud mining platform, now enables US participants to earn 1,100 XRP daily ($3,520 equivalent) through streamlined contracts—bypassing hardware costs and energy-intensive processes.

The platform combines XRP's appreciation potential with mining-like payouts, featuring $15 sign-up bonuses, daily login rewards, and referral commissions. Its renewable energy-powered operations and institutional-grade security aim to attract both retail and environmentally conscious investors.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows strong potential for upward movement. The combination of technical support levels, institutional interest, and positive partnership news suggests a bullish outlook. Key resistance levels to watch include $3.33 (Bollinger Upper Band) and the psychologically important $5 threshold that traders are monitoring.

| Price Level | Significance |

|---|---|

| $2.82 | Strong Support (Bollinger Lower Band) |

| $3.07 | 20-Day Moving Average |

| $3.33 | Immediate Resistance |

| $5.00 | Key Psychological Level |